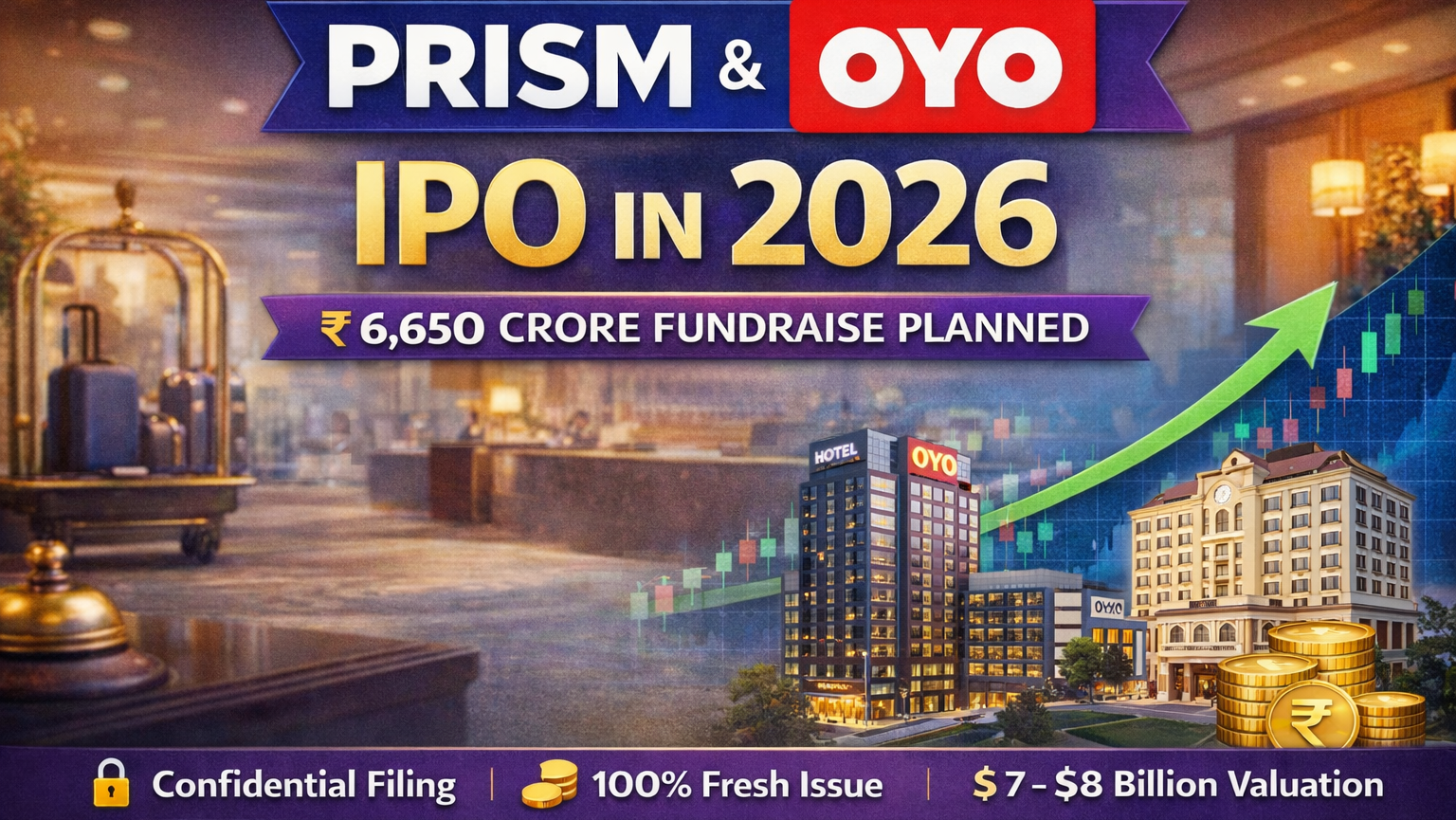

PRISM (OYO) IPO 2026: DRHP Filed, GMP & ₹200Cr+ Profit!

Travel and hospitality technology company PRISM, which owns OYO, has filed a confidential Draft Red Herring Prospectus (DRHP) with SEBI. The company plans to go public in 2026 and aims to raise up to ₹6,650 crore through a fresh issue of shares.

This is PRISM’s second attempt at listing, but this time the company is entering the market with much stronger financials and improved profitability.

1. PRISM (OYO) IPO Issue Highlights

| Particulars | Details |

|---|---|

| Issue Size | Up to ₹6,650 crore |

| Issue Type | 100% Fresh Issue |

| Expected Valuation | $7 billion – $8 billion |

| Filing Route | Confidential DRHP with SEBI |

| Lead Managers | ICICI Securities, Axis Capital, Goldman Sachs, Citibank |

2. PRISM (OYO) IPO GMP Status

Since PRISM has filed via the confidential route, details like price band and IPO dates are not public yet. Because of this, Grey Market Premium (GMP) activity has not started.

GMP usually becomes active only after the Red Herring Prospectus (RHP) and price band are announced.

| GMP Date | IPO Price | GMP (₹) | Estimated Listing Price |

|---|---|---|---|

| TBA | TBA | TBA | TBA |

3. OYO Financial Performance

Compared to its earlier IPO attempt, PRISM is now showing clear improvement in revenue growth and profitability.

| Metric | Q1 FY26 (June Quarter) | Year-on-Year Growth |

|---|---|---|

| Revenue from Operations | ₹2,019 crore | +47% |

| Net Profit (PAT) | More than ₹200 crore | Profitable |

| Gross Booking Value (GBV) | ₹7,227 crore | +144% |

Credit rating agency Moody’s has reaffirmed PRISM’s B2 corporate family rating with a stable outlook. It expects EBITDA to rise to around $280 million in FY25–26.

4. Growth Strategy & Recent Moves

- US Expansion: Acquired G6 Hospitality, owner of Motel 6 and Studio 6 brands.

- Premium Focus: Expanding higher-end brands like SUNDAY Hotels and Palette.

- Better Efficiency: Cost control and better property-level economics across India and Europe.

5. PRISM (OYO) IPO FAQs

1. When is the PRISM (OYO) IPO expected to launch?

The PRISM (OYO) IPO is expected to launch in 2026, after the company filed a confidential Draft Red Herring Prospectus (DRHP) with SEBI. The exact IPO dates will be announced once the public RHP is filed.

2. What is the expected issue size of the PRISM (OYO) IPO?

PRISM plans to raise up to ₹6,650 crore through a 100% fresh issue. As of now, no Offer for Sale (OFS) is planned.

3. What is the expected valuation of PRISM (OYO) in the IPO?

The IPO is expected to value PRISM at around $7 billion to $8 billion, based on market estimates and media reports.

4. What is the Grey Market Premium (GMP) of the PRISM (OYO) IPO?

Currently, the GMP is not available as PRISM has filed via the confidential route. GMP activity usually begins only after the IPO price band and dates are officially announced.

5. Why is PRISM (OYO) filing the IPO through the confidential route?

Filing through the confidential route allows PRISM to test investor interest, refine financial disclosures, and delay public scrutiny until closer to the listing. This approach is commonly used by large global companies.

6. Is the PRISM (OYO) IPO better positioned than its earlier attempt?

Yes. Compared to its earlier IPO attempt, PRISM now demonstrates strong revenue growth, improved profitability, a positive EBITDA outlook, and better cost efficiency, making the 2026 IPO structurally stronger.

Disclaimer: This information is based on market reports and confidential filings. Please read the final RHP and consult a financial advisor before investing.